Dominican Tax Office Releases Instructional Videos for Small to Medium Sized Businesses and Individuals

| Dominican Tax Office Releases Instructional Videos for Small to Medium Sized Businesses and Individuals The Dominican Tax Office (DGII) has released a series of educational videos on Tax Education for contributors in small to medium sized businesses and individuals with the goal of providing guidance and assistance about tax proceedings. … to facilitate voluntary compliance in their transactions to pay the Tax on Immovable Property (IPI in Spanish); the declaration and payment of the ITBIS; payment of Income Tax (ISR); andto learn how to perform tax operations in the Virtual Office. This is a guide produced by the Dominican Tax Office’s Department of Tax Education to facilitate voluntary compliance in their transactions to pay the Tax on Immovable Property (IPI in Spanish); the declaration and payment of the ITBIS; payment of Income Tax (ISR); andto learn how to perform tax operations in the Virtual Office as well as all other information needed about Fiscal Printers The DGII in its 2014-2017 Strategic Plan has proposed bringing the administration closer to the contributor to make it the main source of tax assistance. These five instructional videos are available on the DGII’s YouTube channel or directly on the institution’s web page www.dgii.gov.do under the Publications section. In addition, the Dominican Tax Office will show these videos at training activities geared for contributors, small to medium sized businesses, teachers and university students. This project is part of the Dominican Tax Office’s Program for Institutional Development and falls under an agreement signed in 2008 between the Dominican Government and the Inter-American Development Bank (IDB). The objective of the project isto strengthen the Tax Administration in terms of its autonomy and its organizational development, to increase its use of information technology in fiscal processes, and to promote greater equality in the taxing system to reduce the cost of compliance to contributors and make tax evasion more difficult. |

Related News

-

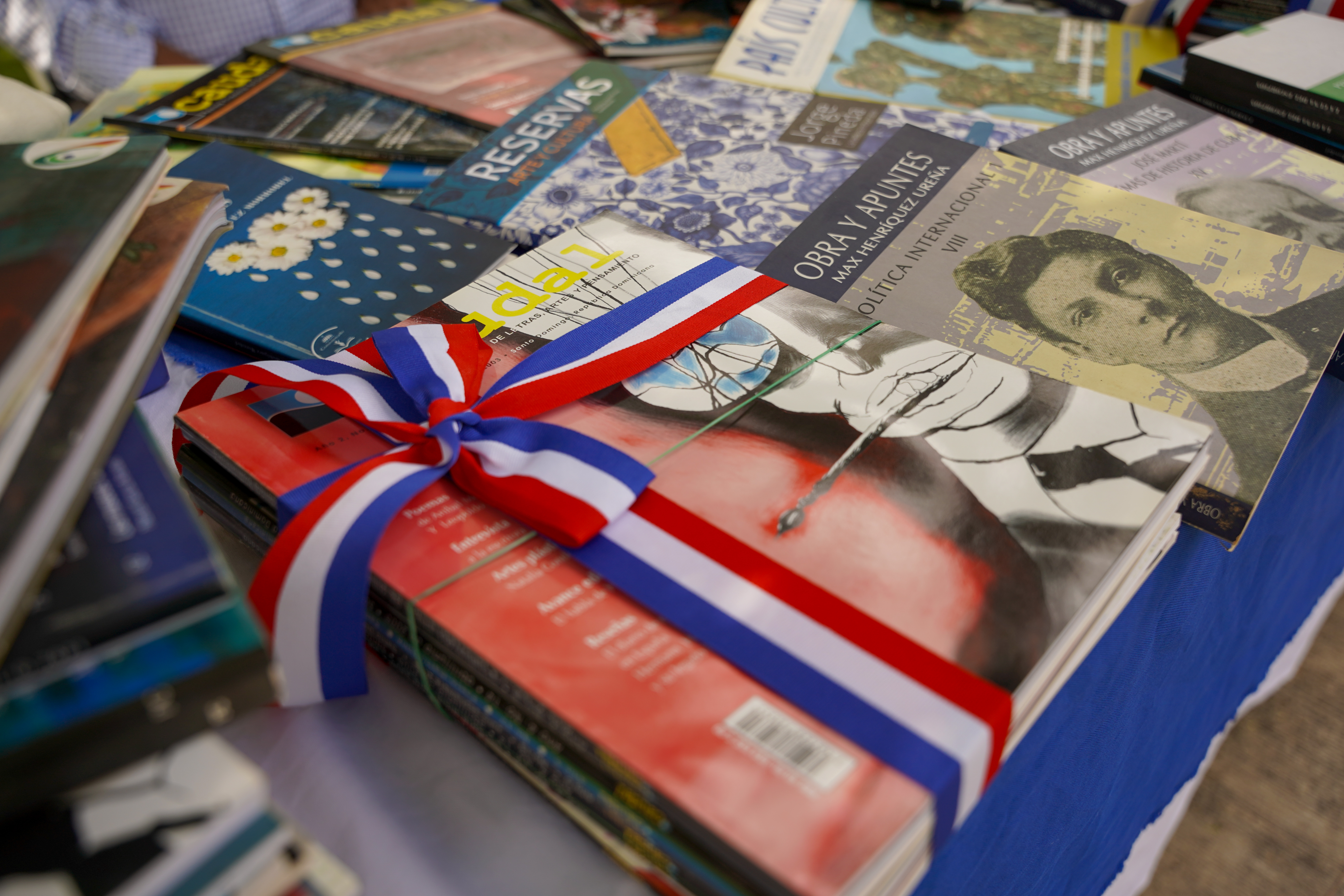

(Versión en español) XI Feria Internacional del Libro y la Cultura Neiba 2024

-

(Versión en español) Cultura y BNPHU otorgan el Premio Biblioteca Nacional de Literatura Infantil 2024 a la escritora Brunilda Contreras

-

(Versión en español) Cultura celebra Día Internacional del Libro con apertura de biblioteca, donación, intercambio y venta de libros

-

(Versión en español) El agroturismo diversifica la oferta turística dominicana

-

Dominicanos en Grandes Ligas

Las ultimas noticias/novedades de lo que acontece con los Dominicanos en las Grandes Ligas durante toda la temporada 2019.